How to claim the energy tax credit. The recently passed energy star tax credit offers a federal tax credit of up to 200 for replacement windows and 500 for replacement doors.

Scam Alerts Australian Taxation Office

Scam Alerts Australian Taxation Office

If you have received energy credits between 2006 and 2010 for energy efficiency improvements totaling 500 or more and 200 of the total improvements were for windows you cannot receive a window tax credit as of 2012.

.png)

How to file taxe credit for window what box. Tax returns cover the financial year from 1 july to 30 june and are due by 31 october. The windows must qualify as being energy efficient and the residence where you replace the windows must be your principal residence which means you must reside in it. You can also lodge with a paper tax return or through a registered tax agent.

The irs institutes a lifetime limitation on energy credit claims. Send all information returns filed on paper to the following. The irs website will tell you which tax filing tools you can use for free and point you to ones that can also do your state taxes for you if your state requires you to file a tax return.

Yes if your windows qualify as an energy efficient improvementthese are entered in the deductions credits section. How do i claim the foreign tax credit without filing form 1116. This page provides the addresses for taxpayers and tax professionals to mail paper forms 1096 to the irs.

If your adjusted. Replacing windows and doors with energy efficient products qualifies for this tax credit including our infinity from marvin windows and waudena millwork entry doors. Lodging online with mytax is the easiest way to do your own tax.

In total homeowners may receive no more than 500 in total energy efficiency tax credits. The credit is worth 10 of the cost of the windows. Windows must have been installed after january 1 2012.

Turbotax either wants the sch a box checked or a form 1116 but told me i dont need to file 1116. On a side note you can also get a 500 tax credit on doors. If you are considering replacing your windows you might qualify for an energy tax credit of up to 1500 as detailed in the american recovery and reinvestment act of 2009.

To claim the energy tax credit you need to file form 5695 alongside your tax return. If you need help finding a piece of software that can do your state taxes for free the website of your states revenue department may provide more information. With your return open search for energy improvements in the program search boxdont search for energy credit as this will take you to the wrong place in the program.

If your principal business office or agency or legal residence in the case of an individual is located in. Homeowners are eligible to receive a tax credit equal to 10 of the product cost installation costs are not included in the rebate calculation with a maximum federal tax credit of no more than 200. Its capped at a 200 tax credit for windows that meet the restrictions.

Jackson Hewitt Online 2019 Tax Year 2018

Jackson Hewitt Online 2019 Tax Year 2018

Credit Karma Tax 2019 Tax Year 2018 Review Pcmag

Credit Karma Tax 2019 Tax Year 2018 Review Pcmag

Tax Help Tips Tools Tax Questions Answered H R Block

Rei Forms Live Walkthrough Guide

Rei Forms Live Walkthrough Guide

Freetaxusa Deluxe 2019 Tax Year 2018 Review Pcmag

Freetaxusa Deluxe 2019 Tax Year 2018 Review Pcmag

.png) Scam Alerts Australian Taxation Office

Scam Alerts Australian Taxation Office

Taxes Here S Why You Should Fill Out The New W 4 Form

Taxes Here S Why You Should Fill Out The New W 4 Form

Scam Alerts Australian Taxation Office

Scam Alerts Australian Taxation Office

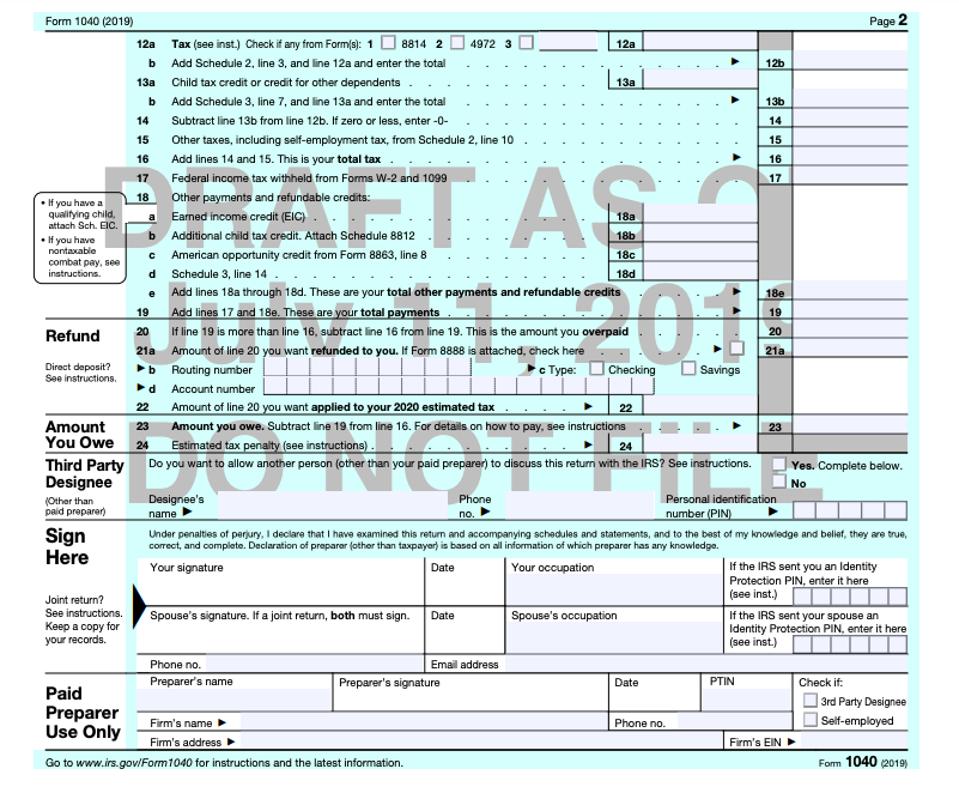

Everything Old Is New Again As Irs Releases Form 1040 Draft

Everything Old Is New Again As Irs Releases Form 1040 Draft

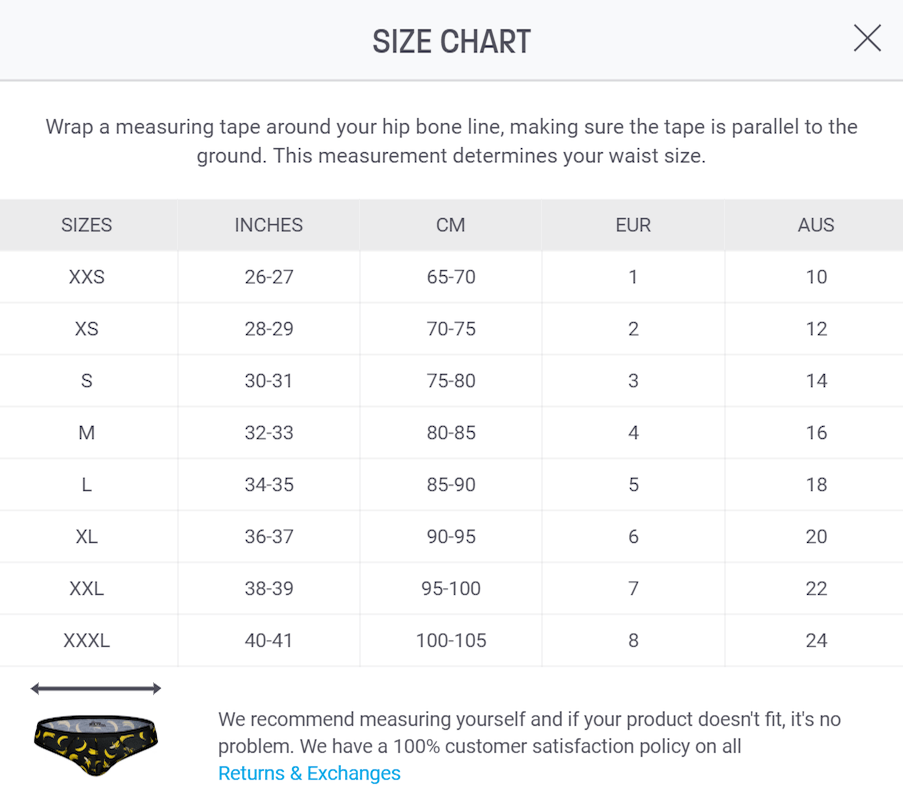

Faq Help On Aussiebum Online Store

Faq Help On Aussiebum Online Store

Home Page Australian Taxation Office

Home Page Australian Taxation Office